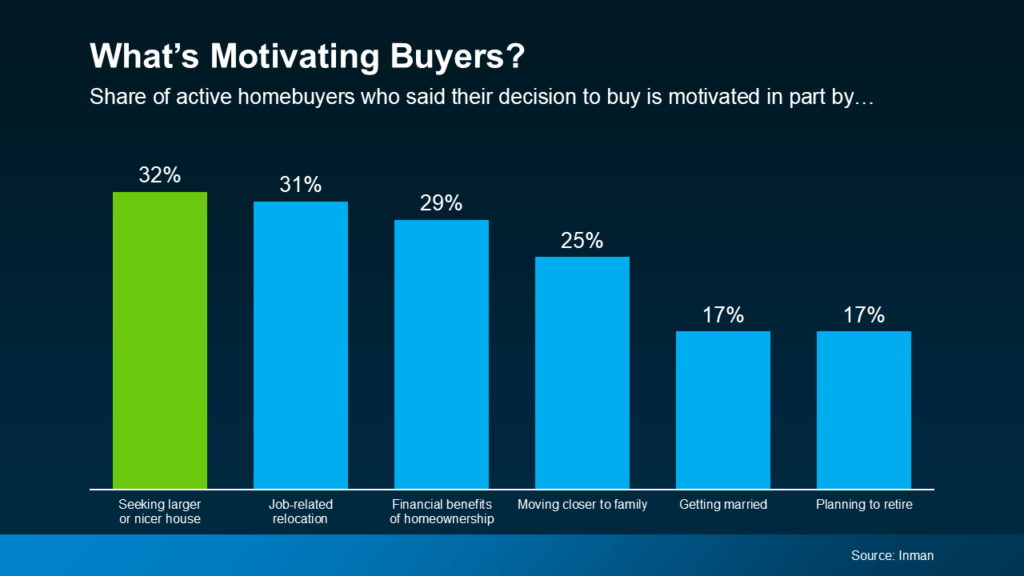

If you’ve been wanting to sell your house and move up to a bigger or nicer home, you’re not alone. A recent Inman real estate news recent survey reveals the top motivator for today’s homebuyers is the desire for more space or an upgraded home (see graph below):

But there’s also a good chance you, like many other people, have been holding off on that goal because of recent housing market challenges. It makes sense – when you’re planning an upgrade that could increase your monthly housing costs, home affordability has a huge impact on when you make your move. But there’s good news: now’s actually a time to evaluate and research your options to make that move happen. Here’s why.

You Have a Lot of Equity To Leverage

One of the key benefits in today’s market is the amount of equity you’ve likely built up in your house over the years. Even with recent shifts in the housing market, national and Santa Fe home prices have steadily grown, adding to the equity homeowners have today. Selma Hepp, Chief Economist at CoreLogic, explains it well:

“Persistent home price growth has continued to fuel home equity gains for existing homeowners who now average about $315,000 in equity and almost $129,000 more than at the onset of the pandemic.”

What does that mean for you? If you’ve been in your home for a few years, you’re probably sitting on a significant amount of equity. You can put that toward the down payment on your next home, helping keep the amount you borrow within a comfortable range.

This can make upgrading more achievable than you might think. If you’re curious how much you’ve built up over the years, ask your real estate agent for a professional equity assessment.

Mortgage Rates Have Fallen, Boosting Your Purchasing Power

And there’s another big reason why now’s a great time to make your move: mortgage interest rates are lower. Lower rates can help make your future monthly payments more manageable, and they also increase your leverage and purchasing power. As Nadia Evangelou, Senior Economist and Director of Real Estate Research at the National Association of Realtors (NAR), points out:

“When mortgage rates fall, the interest portion of monthly payments decreases, which lowers the total payment. This makes it easier for more borrowers to . . . qualify for mortgages that may have been unaffordable at higher rates.”

That gives you more flexibility when searching for Santa Fe homes and may allow you to afford a house at a price point that was previously out of reach. A trusted lender can work with you to figure out the best plan for your budget. When you are ready, ask me about local mortgage brokers, credit unions and bank professionals for suggestions.

Bottom Line

If you’re ready to sell your current home and find secure the home that fits your lifestyle and family, it’s time to review options. Your equity, paired with lower mortgage rates, puts you in a great position to make that move a possibility.

To make the best decisions and get the most out of your current market advantage, let’s connect to review your situation, equity and options. There is no fee for a confidential conversation about your housing goals and dreams. Schedule a call with a quick request here or call to my cell. Thank you for reading. Emily Medvec